Wow, has it really been 9 days since I posted something here last?

Have been busy but that shouldn't excuse the tardiness. I hope not to repeat this again. I haven't been totally off the grid, but have been collecting (assimilating?) info about the LIBOR saga, which is moving into really sticky terrain.

In no particular order,

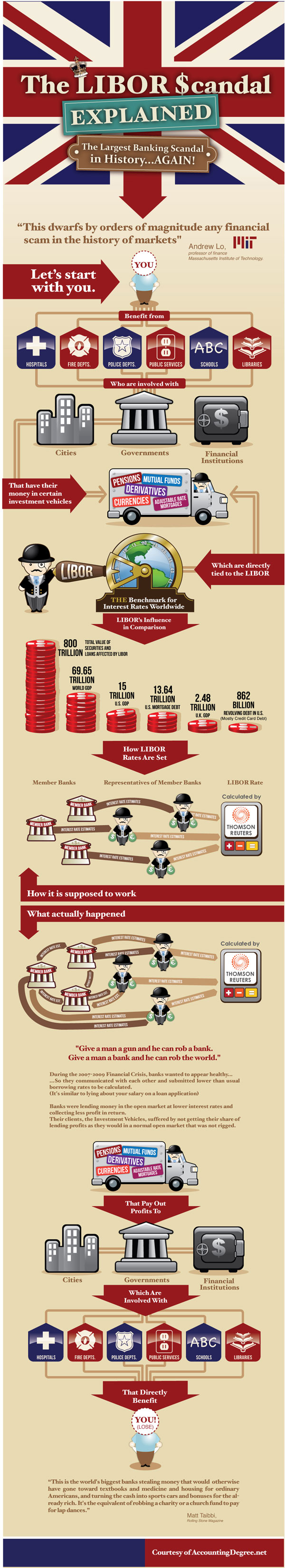

In case you didn't quite get what LIBOR is from my long-winded explanation, here's a much better primer from Donald MacKenzie. What's in a number? One very important part that I left out earlier is that each input given by a bank is made public soon after the day's rate is published, which means that the manipulation, if any, was done entirely in public.

Here's a link to a MS report on 'LIBOR Risk Sizing' for banks. A lot of jargon. Skip past all the predictions; if someone's put it down on paper somewhere, its a pretty good bet its not going to happen. The interesting part begins from Page 7 onwards, where they start with implications for UK banks, then go on to give details of litigation that the banks find themselves in, and on Page 9, where they give the disclosures that various banks have made in their filings. UBS looks next in the firing line, which is also what the chatter around the market has been.

Some good editorials/blog posts: Lie More, as a Business Model, where the author correctly identifies the role of incentives in this, and in my opinion, most other scams. If your income depends on you lying, chances are that you will lie. Also read this excoriating piece from the Economist: The Rotten Heart of Finance. From The London Banker, which I haven't been following, but must now, comes Lies, Damn Lies and LIBOR.

And from FT's Martin Wolf:

My interpretation of the Libor scandal is the obvious one: banks, as presently constituted and managed, cannot be trusted to perform any publicly important function, against the perceived interests of their staff. Today’s banks represent the incarnation of profit-seeking behaviour taken to its logical limits, in which the only question asked by senior staff is not what is their duty or their responsibility, but what can they get away with.

Ouch.

The Economist, also to be noted, has made 'Banksters' an official term. This will hurt.

The Telegraph says Lock 'em up!

Here's a linkfest not of my making. The Big Picture blog rounds up articles from 2007-08 which were talking about the LIBOR scandal. None of this is new, its just blowing up now...

September 26, 2007: The Financial Times – Gillian Tett: Libor’s value is called into questionOne of these is a growing divergence in the rates that different banks have been quoting to borrow and lend money between themselves. For although the banks used to move in a pack, quoting rates that were almost identical, this pattern broke down a couple of months ago – and by the middle of this month the gap between these quotes had sometimes risen to almost 10 basis points for three month sterling funds. Moreover, this pattern is not confined to the dollar market alone: in the yen, euro and sterling markets a similar dispersion has emerged. However, the second, more pernicious trend is that as banks have hoarded liquidity this summer, some have been refusing to conduct trades at all at the official, “posted” rates, even when these rates have been displayed on Reuters.April 16, 2008: The Wall Street Journal – Bankers Cast Doubt On Key Rate Amid Crisis

The concern: Some banks don’t want to report the high rates they’re paying for short-term loans because they don’t want to tip off the market that they’re desperate for cash. The Libor system depends on banks to tell the truth about their borrowing rates. Fibbing by banks could mean that millions of borrowers around the world are paying artificially low rates on their loans. That’s good for borrowers, but could be very bad for the banks and other financial institutions that lend to them.May 2, 2008: The Wall Street Journal – Libor’s Guardian Bristles At Bid for Alternative Rate

The group that oversees a widely used interest rate fired back Thursday at an effort to introduce an alternative to the rate, known as the London interbank offered rate, or Libor. In recent weeks, the British Bankers’ Association, which calculates Libor, has faced questions about the accuracy of the rates that a 16-bank panel submits to reflect their dollar-denominated borrowing costs. The group said a review of how Libor is calculated “is due to report shortly,” though it declined to offer an exact date. It also noted that any substitute for Libor — which is supposed to reflect the rates at which banks make short-term loans to one another — would have to meet high standards to “win the market’s confidence.” On Wednesday, ICAP PLC, a London broker-dealer with offices in New York, said it plans to launch a new measure of the rates at which banks borrow dollars. ICAP expects to begin publishing the rate, known as the New York Funding Rate, or NYFR, as soon as next week, said Lou Crandall, chief economist at Wrightson ICAP, a New Jersey research firm that is part of the ICAP group. Mr. Crandall said NYFR isn’t intended to replace Libor.September 24, 2008: The Wall Street Journal: Libor’s Accuracy Becomes Issue Again

Questions on Reliability of Interest Rate Rise Amid Central Banks’ Liquidity Push

Earlier this year, Libor appeared to be sending false signals. Banks complained to the BBA that rival banks might not be reporting their true borrowing costs because they didn’t want to admit that others were treating them as if they had troubles. That led to a BBA review and the pledge that the rates banks contribute would be better policed. Every morning, 16 banks submit borrowing rates in a process that produces Libor rates at lunchtime in London.October 20, 2008: The Wall Street Journal – Bank-Lending Boost Could Spur Thaw

On Friday, three big banks led by J.P. Morgan Chase & Co. made multibillion-dollar offers of three-month funds to European counterparts, causing an immediate stir in the shriveled markets for unsecured lending. That raised expectations that lenders would finally open their doors and businesses would be able to borrow again, removing one of the biggest stresses on the global economy.In the story above (October 20, 2008), JP Morgan, a two trillion dollar bank, made $10 to $15 billion of LIBOR loans to other multi-trillion dollar banks and then proudly announced that LIBOR rates had fallen, the market was thawing and the credit crisis was easing. As we wrote in 2008, this was nothing short of rigging the market.Sum it up and all the revelations we are reading about this week were already evident about four years ago. None of should be surprising. As Jean-Claude Juncker told us last year, “when it becomes serious, you have to lie.”

David Merkel of The Aleph Blog delves into the LIBOR rates from 2005-2008 and this is what he comes up with:

My initial diagnosis is this: whether formally or informally, you have two groups of banks submitting rates for LIBOR. One group is trying to pull LIBOR up, the other is trying to pull LIBOR down. Statistically, if I add up their intercept terms from the first table, they both sum to 0.23%, one positive, the other negative. Even if LIBOR were a simple average, which it is not, this is a colossal game of tug of war, with two equal teams.As it is, LIBOR excludes the outliers, and calculates an average off of those that remain. It’s a difficult measure to manipulate. There may have been attempts to manipulate LIBOR, and even two groups of banks trying to pull LIBOR their own way, but successful systemic manipulation of LIBOR is unlikely in my opinion.But if you disagree, here are the two clusters of banks, pursue their collusions:Coalition to pull LIBOR up

- Barclays

- BTMU

- Credit Suisse

- HBOS

- Norinchuckin

- RBS

Coalition to pull LIBOR down

- Citi

- HSBC

- JP Morgan

- Lloyds

- Rabobank

Start with Barclays and JP Morgan, they are the outliers, and if there is collusion, they are the likely leaders.

When all this is settled, it'll only be the lawyers who are left standing. Lawsuits...and more of the same. Apparently, we're moving on to criminal charges as well, which would be novel. Also here and here. My question is, why isn't any Indian firm suing these banks? C'mon, surely, surely someone in India has entered into a LIBOR-backed transaction. Who'll step up?

The regulators knew something shady was up and really didn't bother about it... Here's Reuters on the same. This is the turn that the scandal has taken in the past week, with the focus shifted to the regulators. The NY Fed basically admitted that it knew Barclays used to manipulate LIBOR and did almost nothing about it. This should mean more bad news for the banks. If the regulators find themselves falling into a shit-hole, you can damned well be sure that they won't go in there first, or at least, not before pushing everyone else in before them. And now they'll be under more pressure to come down even more harshly on the banks.

And after reading all this LIBORamayana, if you're still asking who/what LIBORam is, go here and here and also, see this:

No comments:

Post a Comment