And it has this kickass image as well. Make sure you enlarge and enjoy!

Short takes on happenings in the Indian financial sector. Plus dashes of other interesting stuff thrown in. Enjoy!

Sunday, December 16, 2012

Game of Phones (and content) (and hardware) (and search)

A great article by The Economist: Another Game of Thrones

And it has this kickass image as well. Make sure you enlarge and enjoy!

And it has this kickass image as well. Make sure you enlarge and enjoy!

Tuesday, November 20, 2012

The Derating of the MBA

This is being passed around MBA circles. Can't disagree with much of it.

***************************************************************************************

The derating of the MBA

The MBA damages society in many different ways. The first of which is such misallocation of talent.

A cousin of mine, who is the Head of Risk at a leading Indian fund house, met a bright young graduate from Kolkata’s elite Presidency College a few years ago. This encounter took place in Mumbai and my cousin, already well established on the corporate ladder by then, advised the young man to pursue an MBA. The youngster replied that he had come to Mumbai to become a Music Composer and had no intention of pursuing an MBA. You, I and my cousin should now be thankful for the Presidency graduate’s determination – had this youngster become a corporate drone, we probably would have never heard about Pritam Chakraborty, my current favourite Music Composer.

As I go on to explain in this column, the MBA damages society in many different ways the first of which is such misallocation of talent – people who have deep talents in a variety of different spheres of life get sucked into the MBA because it represents what appears to be a relatively low risk route to a meal ticket in the corporate world. The damage that this apparently low risk meal ticket inflicts at a personal level was captured beautifully in the highest grossing Bollywood movie of all time, “Three Idiots” (although, I confess that the focus of that movie is more on IIT than on the MBA).

In my line of work, investment advice, and more generally, in investment management, the MBA is arguably even more damaging. My reading of the most successful investment managers is that they tend to be patient, level-headed, resilient individuals who have the fortitude to stand their ground in the face of waves of fear and greed that sweep through the market. The MBA represents the anti-thesis of this mindset – in the words of one of India’s most successful fund managers, “An MBA wrecks your mind…it instils in you all the wrong things about corporate life and does not teach you what you actually need to know about Finance, about Balance Sheets, about investing, about patience.”

Thirdly, the MBA is a bad investment for the majority of those who do it. Through entrance exams – CAT, GMAT, etc – the MBA filters the best brains of a generation into a classroom where Economics & Finance 101 is imparted in dressed up format with overheated business jargon for one or two years. Then everyone is packed into a pen, spruced up and readied for recruiters to come and choose. Now, let’s segment the kids in the pen into two lots to see how this game works.

The winners, i.e. the whizkids, the real superstars of the generation, would have got a job anyway regardless of whether they had spent two years in business school or otherwise; for them the two years is pure “opportunity cost”. These people had the aptitude to structure mergers, analyse investments, create marketing plans, etc – the MBA simply delayed their entry into the labour market and made them enter on terms specified by the recruiter.

The losers i.e. those without innate talent would have struggled in any case to enter the elite professions. The MBA is unlikely to change that – last I heard, the qualification is not known to increase intelligence. But by giving them hope of rising above their limitations, the MBA basically played a confidence trick on them, the same confidence trick that the advertisers of hair tonic or quacks peddling “get rich quick” schemes sell.

Hence for neither category does the MBA really deliver long term cashflow uplift – what it does is use the success of the winners to suck in the next generation of losers. I appreciate that there will be a small minority of people for whom the MBA was a life changing experience and allowed them to switch to a more lucrative profession but, unless these people were oblivious to basic Finance and Economics, that “switch” is unlikely to have come from the content of the MBA.

The good news is that India seems to have wised up to the adverse effects of the MBA. In 2008, 2.76 lakh unfortunates registered for the CAT. After steadily falling for three years, in 2012 the figure has perked up a touch to 2.10 lakh. My high school statistics tells me that this is a CAGR of negative 7%. If this trend continues for another 10 years then only half the number of bright young Indians (around 1 lakh youngsters) will be subjected to the competitive drudgery of CAT. The possibility that within the next decade, less than 100,000 Indians will sit for CAT every year is a very happy thought; that is the sort of change I would like to believe in.

BY SAURABH MUKHERJEA, HEAD OF EQUITIES, AMBIT CAPITAL

(Saurabh Mukherjea is the Head of Equities at Ambit Capital. The views expressed here are his own and not Ambit Capital’s. The author confesses that he does not have an MBA).

Labels:

MBA

Thursday, October 25, 2012

Monday, September 10, 2012

Brilliantly Ballsy

This article is an absolute blast: http://skift.com/2012/09/05/ryanair-boss-michael-oleary-gives-best-quotes-in-the-industry/

Michael O'Leary might just have become my new favourite CEO. He's the CEO of Ryanair, a low-cost Irish airline. His approach to customer satisfaction is: "I'll get you there. For everything else, you pay me." I find it hard to disagree.

Some of his best quotes, taken directly from the above link:

Michael O'Leary might just have become my new favourite CEO. He's the CEO of Ryanair, a low-cost Irish airline. His approach to customer satisfaction is: "I'll get you there. For everything else, you pay me." I find it hard to disagree.

Some of his best quotes, taken directly from the above link:

On passengers who forget to print their boarding pass: “We think [they] should pay 60 euros for being so stupid.”

On refunds: “You’re not getting a refund so **** off. We don’t want to hear your sob stories. What part of ‘no refund’ don’t you understand?”

On customer service: “People say the customer is always right, but you know what – they’re not. Sometimes they are wrong and they need to be told so.”

On overweight passengers: “Nobody wants to sit beside a really fat ****** on board. We have been frankly astonished at the number of customers who don’t only want to tax fat people but torture them.”

On beginning a press conference to announce the annual results: “I’m here with Howard Miller and Michael Cawley, our two deputy chief executives. But they’re presently making love in the gentleman’s toilets, such is their excitement at today’s results.”

On apologies: “Are we going to say sorry for our lack of customer service? Absolutely not.”

On Ryanair’s image: “One of the weaknesses of the company now is it is a bit cheap and cheerful and overly nasty, and that reflects my personality.”

On Guardian readers: “The chattering bloody classes, or what I call the liberal Guardian readers, they’re all buying SUVs to drive around London. I smile at these loons who drive their SUVs down to Sainsbury’s and buy kiwi fruit from New Zealand. They’re flown in from New Zealand for Christ sakes. They’re the equivalent of environmental nuclear bombs!”

On environmentalists: “We want to annoy the ******* whenever we can. The best thing you can do with environmentalists is shoot them. These headbangers want to make air travel the preserve of the rich. They are luddites marching us back to the 18th century. If preserving the environment means stopping poor people flying so the rich can fly, then screw it.”

On protesters: “The Swampies of this world are climbing up trees to protest about airlines and airports. They should all get a job and get a ******* life.”

On consultants: “I believe hiring consultants is an abdication by management of their responsibilities. If the consultant is so good at managing change, then why not hire him to run the company and do it himself? Every idiot who gets fired in the industry shows up as a consultant somewhere. I would shoot any consultant who came through my door.”

On turbulence: “If drink sales are falling off we get the pilots to engineer a bit of turbulence. That usually spikes up the drink sales.”

On corporate life: “The meek may inherit the earth, but they will not have it for long.”

On travel agents: “Screw the travel agents. Take the ******* out and shoot them. They are a waste of bloody time. What have they done for passengers over the years?”

On ordering aircraft from Boeing: “The message to Boeing today is: ‘You keep building them, we’ll keep buying them’, and together both of us will kick the crap out of Airbus in Europe. We love Boeing. **** the French.”

On not ordering more aircraft from Boeing: “Boeing had their chance. Eventually you lose interest, dealing with a bunch of idiots who can’t make a decision. They are a bunch of numpties out in Seattle.”

On transatlantic flights: “Ryanair will never fly the Atlantic route because one cannot get there in a Boeing 737, unless one has a very strong tail wind or passengers who can swim the last hour of the flight.”

On the airline industry: “There’s a lot of big egos in this industry. Most chief executives got into this business because they want to travel for a living. Not me, I want to work.”

On European expansion: “Germans will crawl *******-naked over broken glass to get low fares.”

On Ryanair in the 1990s: “Ryanair will never make money. It will always lose money. It’s an airline. Forget it.”

On Ryanair in the 2000s: “We expect our profits to grow by 20 to 25 per cent. That’s not just good, that’s practically obscene in an industry in which few people make money. This isn’t an airline, it’s a drug baron’s business.”

On charging passengers to use the loo: “One thing we have looked at is maybe putting a coin slot on the toilet door so that people might actually have to spend a pound to spend a penny in the future. If someone wanted to pay £5 to go to the toilet I would carry them myself. I would wipe their bums for a fiver.”

On upright seating: “I’d love to operate aircraft where we take out the back ten rows and put in hand rails. We’d say if you want to stand, it’s five euros. People say ‘Oh but the people standing may get killed if there’s a crash’. Well, with respect, the people sitting down might get killed as well”

On the in-flight experience: “Anyone who thinks Ryanair flights are some sort of bastion of sanctity where you can contemplate your navel is wrong. We already bombard you with as many in-flight announcements and trolleys as we can. Anyone who looks like sleeping, we wake them up to sell them things.”

On low fares: “I don’t see why in 10 years’ time you wouldn’t fly people for free. Why don’t airports pay us for delivering the passengers to their shops?”

If you can’t find a low fare on Ryanair: “You’re a moron.”

On publicity: “I don’t mind dressing up in something stupid or pulling gormless faces if it helps. Frankly, I don’t give a rat’s arse about my personal dignity.”

With Ryanair’s marketing manager, Sinead Finn, addressing an all-male press conference when she said: “I’ve got nine men in front of me. I don’t know where to start”: “They’re hardly all men. One of them is from the Guardian.”

At an over-hyped press conference: “I’m a bit disturbed – the rumour went round we would announce my resignation and the share price rose three per cent.”

On Ryanair passengers: “Do we carry rich people on our flights? Yes, I flew on one this morning and I’m very rich.”

On BAA: “BAA want to spend £4 billion on an airport which should cost £100 million. £3.9 billion is for tree planting, new roadways and Norman Foster’s Noddy railway so they can mortgage away the future of low-cost airlines. This plan is for the birds. BAA are a glorified shopping mall.”

On breaking up BAA: “A break-up of BAA would be the greatest thing that has happened to British aviation since the founding of Ryanair. Then airline customers would not be forced to endure the black hole of Calcutta that is Heathrow or the unnecessary, overpriced palace being planned at Stansted.”

On how to settle differences with Dublin Airport: “With Semtex. Preferably during a board meeting.”

On new routes: “Sometimes there is not even a road to the airports we fly to. It is immaterial.”

On expansion: “We would like to base more aircraft here in Belfast and are working with the City Airport to get the runway extended. Let’s get the planning permission through and let’s ignore the mewling and puking from local residents which is a load of nonsense. If you don’t like living beside an airport, sell the house and move.”

On flying to Cornwall: “Newquay is the surf and dope capital of Britain. There’s next to frig-all way of getting to Cornwall unless you fly. It’s a ******* impossible nine-day hike. Closing that airport would be a disaster for surfer dudes, but also to loads of wealthy types who use us to commute up and down. I tell you, we’ll have a bloody dogfight with the RAF. Watch out for those 737s on your wing, flyboys!”

On pilot’s wages: “People ask how we can have such low fares. I tell them our pilots work for nothing.”

On his popularity: “I don’t give a ***** if no-one likes me. I am not a cloud bunny, I am not an aerosexual. I don’t like aeroplanes. I never wanted to be a pilot like those other platoons of goons who populate the airline industry.”

On his bride arriving 35 minutes late for their wedding: “She’s coming here with Aer Lingus.”

On paternity leave: “We have paternity leave but it’s a bloody joke. It is bull**** legislation. You need a couple of days off because you’ve had a baby, but this nonsensical rubbish that you’re entitled to days off for the first six years of a baby’s life. Go and get a bloody job – get a life.”

On wealth: “I buy everything low-cost. I buy cheap shirts. I buy cheap shoes. It’s a philosophy. I’m just cheap.”

On Ireland: “The airline industry is full of bull*******, liars and drunks and we excel at all three in Ireland.”

On retirement: “It would be very difficult for me to don a tie and go on to committees. Could you imagine me getting a knighthood? Puke. The weakness of British Airways is that everyone is looking for a knighthood. I plan to go on and on, like Chairman Mao.”

On free speech: “I upset a lot of people because I tell them what I think. I’m disrespectful towards what is perceived to be authority. Like, I think the Prime Minister of Ireland is a gob*****.”

On politics: “I think the most influential person in Europe in the last 20 to 30 years has been Margaret Thatcher, who has left a lasting legacy that has driven us towards lower taxes and greater efficiency. Without her we’d all be living in some French bloody unemployed republic.”

On the European Commission: “They are ******* Kim Il-Jungs (sic) in the Commission. You cannot have civil servants trying to design rules that make everything a level playing field. That’s called North ******* Korea, and everybody is starving there. The EU are pursuing some form of communist ******* Valhalla.”

On EU Commissioner Neelie Kroes’s approval of an Alitalia/Air One merger: “She”ll be rolling over like a poodle having her tummy tickled and rubber-stamping the thing.”

On how to keep employees motivated and happy: “Fear.”

On British Airways: “BA have got waterfalls in their head office. The first thing I’d do if I were in charge of BA is turn off the waterfalls. The only time we have waterfalls in the Ryanair office is when the toilet leaks.”

On the British Airways/Iberia merger: “It reminds me of two drunks leaning on each other.”

On Ryanair’s pilots: “If this is such a Siberian salt mine and I am such an ogre, then why are they still working for the airline? If any of our fellas aren’t happy with the current arrangement then they’re free to go elsewhere. Godspeed to them.”

On Aer Lingus’s pilots: “Overpaid, underworked peacocks”

On employees: “MBA students come out with: “My staff is my most important asset.” Bull****. Staff is usually your biggest cost. We all employ some lazy ******* who needs a kick up the backside, but no one can bring themselves to admit it.”

On cost-cutting: “We use our own biros and I tell the staff not to buy them, just pick them up from hotels, legal offices, wherever. That’s what I do. Recently I did an interview and I was sitting there with a hotel pen I’d nicked from somewhere. I was asked why and I said: ‘We at Ryanair have a policy of stealing hotel pens. We won’t pay for Bic biros as part of our obsession with low costs.”

On Sir Stelios Haji-Ioannou, founder of easyJet: “Those of us who sell the lowest fares just get on with it, and those who do not, write whingeing letters to newspapers.”

On intelligence: “easyJet are not the brightest sandwiches in the picnic basket.”

On Southwest Airlines: “We went to look at Southwest Airlines in the US. It was like the road to Damascus. This was the way to make Ryanair work. I met with Herb Kelleher. I passed out about midnight, and when I woke up again at about 3am Kelleher was still there, the *******, pouring himself another bourbon. I thought I’d pick his brains and come away with the Holy Grail. The next day I couldn’t remember a thing.”

On Alitalia: “I would not want it if it were given to me as a present.”

To the boss of regional airline Aer Arann: “**** off back to Connemara where you come from!”

On offering advice to other airlines’ bosses: “They can **** off and do their own work”

On air marshals: “Air marshals are a complete waste of time. I can’t think of anything that would reduce security more than having a guy on board with a gun.”

On a bomb scare in Scotland: “The police force were outstanding in their field. But all they did was stand in their field. They kept passengers on board while they played with a suspect package for two and three quarter hours. Extraordinary.”

On closing Ryanair’s check-in desks: “This isn’t the end of civilization as we know it.”

Thursday, August 30, 2012

Saturday, August 11, 2012

22,451 (Crores)

Largest ever

quarterly loss in Indian corporate history? Check.

Calling for your

product to be regulated again because its only nudge-nudge-wink-wink ‘deregulated’

now? Check.

The people

supposed to pay you money not having any because they paid you out last time?

Check.

Running out of

cash to pay your suppliers? Check.

IOCL’s quarterly

numbers are a disaster, to put it lightly. Its easy to read a number and go

whoa, without really understanding anything about it. Let’s put it in

context, shall we?

You read about

the latest, greatest mobile phone going around? A little birdie called the

Samsung Galaxy S3? It retails for around 38,000. This loss could buy 59 lakh of

those and dump them in the Arabian Sea. Or wait, IOCL’s a oil company right? With

this much money, you could buy around 300,000 Honda City and dump them too. I’m

sure neither Honda nor Samsung would mind.

Actually, the

most interesting part of this for me is the news that soon IOCL will run out of limits

to buy stuff. Then what happens? Its not like we’re self-sufficient or

anything. Does crude oil inflow just stop? IOCL supplies around 40% of India’s

total crude requirement, so if something’s not done soon, we’re stuffed.

Plus a

4000-crore asset writedown and 3100 crore forex loss? Surely, surely these two

could’ve been minimized? Maybe not the inventory writedown (Brent prices fell

20% during the quarter), but the forex loss?

And yes, nothing

is going to improve till prices, especially of diesel, are raised. Prices can’t

be raised because that loses you votes stokes inflation. And so on.

Another

side-effect is that with these kinda losses, they can’t even go in for capex,

which would have helped them to increase the complexity levels of their

refineries (higher the complexity, the lower the quality of crude oil it can

turn to final products, low quality raw material costs less, hence lesser costs

and more profits) and this leads to GRMs in the range of 4 dollars or so, which

is not quite great, in the spirit of putting things mildly.

Quick question,

just how the hell do equity analysts suggest a price for these oil marketing

cos.? Isn’t just about everything determined by the government? Dunno…

In a couple of

days there will be a lot of equity research reports coming your way, if you’re

into those and I’ll be damned if this isn’t the gist of all of them. Everyone

needs to make a living.

Friday, August 10, 2012

Bear Cartel - II

So as I'd written earlier, I went through the SEBI order on the sudden mid-cap stock crash

and as is the case with most SEBI orders, I found it written up beautifully.

You should really try reading some of these sometime.

I'll try to quickly summarize; my thoughts at the

end.

- On July 26th, between 9.15 and 9.50 am, prices

of Pipavav Defence (PDO), Parsvnath Developers (PVD) and Glodyne

Technoserve (GDT) fell suddenly and without cause by 20% and that of Tulip

Telecom (TLT) by 25%. The marke, and SEBI, went WTF?!?

- NSE and BSE both dug into the list of sellers

and came up with the list of 19 entities which I'd posted here.

- The net sales by these entities in those four

stocks ranged from 51% to 95% of the market on NSE and 31% to 58% of the

market on BSE. They underbid on the stock by as much as 36% in

some cases. They were acting in unison i.e. one after the other. One would

place an order and after that got executed, someone else would place

another order and so on. And as one or two were driving prices downward,

other group entities were buying up the shares.

- SEBI dug into these entities and came up with

inter-linkages between them such as:

- Common phone numbers

- Common address

- Directorship in other entity

- Common CA (I found this brilliant)

- One of the guys, Ajit Kumar Jain, was found to

have links with companies that had been banned in the past for price

manipulation.

- A particularly neat touch was when SEBI

pointed out that these guys don't really have the stated income to be

trading in crores of rupees. Most of them were nil or upto 5 lakhs, with

two or three above 25 L.

- These companies, since Jan. 2012 were totally

into trading these four scrips and nothing else. 11 of them traded these

80% of the time or above.

- From the order, directly,

22. In my

view, generally, a seller would rationally seek a higher price to sell his

shares; however, in this case the clients were placing sale orders at

prices lower than LTP, thereby bringing down the price of the scrips. More

importantly, normally a seller would desist from revealing its entire

sell quantity since that may cause the supply-demand balance to immediately

become unfavourable to the seller. The data for the short period of time

in each scrip indicates several instances of fully disclosed orders which

were also a significant factor in causing the sharp decline of

approximately 20% in price of each scrip.

23. One

basic premise that underlies trading on the stock exchanges is that the

clients conform to standards of transparency and ethical behavior

prescribed in the various regulations and statutes, relevant in this

regard and do not indulge in fraudulent , manipulative and unfair trade

practices while dealing in securities. In this case, the above trading

pattern of the clients’ prima-facie indicates that there was a concerted

attempt to artificially manipulate/depress the prices of these scrips in a

disorderly fashion thereby adversely affecting the integrity of the

securities market.

- And then, BOOM, you're barred from the markets

pending further investigation.

But seriously, what were these guys thinking? Did

they really think they could get away with something as blatant as this? I am

also thinking of the ways in which they could have pulled this off without alerting

the regulator.

First of all, get different SIM cards.

In today's day and age, that should seriously not be a concern. Register

different addresses. I'm sure these guys have enough bogus addresses or shell

companies listed anyway. So choose carefully. These two should be no-brainers,

really.

Now it should get interesting. They'll

need different companies, obviously, operating out of the different premises

and having different phone numbers, but they'll need different directors too,

or else they are related parties. A public limited company needs seven minimum

while a private limited needs two. That gives a minimum of four people, in two

pairs, establishing a buyer and a seller. Because if they short a stock and

someone else buys it up they’ll end up losing loads of money. The timing has to

be co-ordinated. You need to establish a pattern of trading across various

stocks before zeroing in on the two-three you want to short. Don’t concentrate

80% of your trading in those.

I’m still not convinced. If one set of

companies does all the selling and another apparently unrelated group of

companies does the buying, doesn’t it become obvious? Maybe the ‘operators’

should settle on less greed. If you end up causing 20% price-drop in 30

minutes, you are bound to raise eyebrows. Why not 5% across multiple scrips,

snap ‘em up and sell them back at normal price? Given the crores in which they

deal, even 5% would be a significant amount. But 20% is pushing it a bit too

far, I think. Plus it gets you debarred.

Use different CA’s for the companies.

That also should not be a problem, ideally.

Ideally, you’d have 5-6 different set

of companies, 6-7 companies constituting a set, operating throughout India

(think Golden Quadrilateral), co-ordinating via Skype (no telephone trails),

selling and buying throughout a session (this would require some serious cash,

but I think they might have that covered). Choose your timing, in the best case

scenario, you should only trigger the selling and spook the market enough so

that they start panicking and selling. That might be a tough nut to crack. Make

sure the individuals and companies involved trade across a range of scrips

before settling on the one you want to manipulate. Random distribution of

profits would ensure everyone gains in the long-run, and collusion is difficult

to prove. This is all a bit too simplistic, yes?

Establishing 30-40 private limited

companies in India would not be a big issue for the concerned parties. An

enquiry here would involve seizure of communication equipment and I don’t think

SEBI is authorized to do that. SEBI’s the regulator, not the police. How do you

prove collusion when there is (apparently) no contact between the parties? They

might be best friends but in the absence of documentation, even friendship is

hard to prove, no?

If you’re a party who knows how shit goes

down and are laughing your guts out at me, let me know. I’d love to learn. (Not

that I’d use it, of course, but knowledge and power and all that jazz...)

If you’re SEBI, what’s your workaround

for this? Do you even need a workaround for this?

Again, putting it on paper is a

gut-wrenching reminder of absolutely how much I have no idea.

Saturday, August 4, 2012

Bear Cartels?

I'm such a noob in the stock markets that it hurts to even think about it.

This is what I came across today: Sebi bars 19 entities for involvement in mid-cap stock crash. Might be the first time I've noticed a 'bear cartel' in action.

I'll try to dig into it for more. In the meantime, if anyone has anything they want to share about these 19 entities, lemme know, yes?

- 4a Financials Securities

- A To Z Steels,

- Ajit Kumar Jain

- Cheminare Trade Comm

- G N Credits

- Gajria Jayna Precision Industries

- Kuvam Plast Pvt Ltd

- Littlestar Vanijya Pvt Ltd

- Manish Agarwal

- Milestone Shares & Stock Broking Pvt Ltd.

- Neelanchal Mercantile Pvt Ltd

- North Eastern Publishing & Advertising Co.

- Passions System Solution

- Premium Hospitality Services

- Ramkripa Securities

- Umang Nemani

- Venus Infosoft

- White Horse Trading Co.

- Yashika Holding Pvt Ltd.

It seems there is quite a lot of cross-holding between these. SEBI's website is down right now, so not able to read the order. Will check it out soon and we'll see how that goes...

Saturday, July 28, 2012

Sunday, July 22, 2012

Water is Wet, Report Finds

Financial Services Professionals Feel Unethical Behavior May Be a Necessary Evil and Have Knowledge of Workplace Misconduct

Alternate Title: Financial Service Professionals Not Exactly The Most Ethical Dudes On The Planet

Wonder who'll do a similar survey/study in India.

Labels:

Finance

Friday, July 20, 2012

Suggested Reading - 1

A Brief History of Money - Or, how we learned to stop worrying and embrace the abstraction

Concise. Well-written. James Surowiecki is one of my favorite 'finance' writers, and this is a good piece by him.

If you're feeling too lazy, you can go through a timeline here.

Fun fact: I was an IEEE member once!

Labels:

IEEE,

James Surowiecki,

Money

Econo-rap...

Sigh, I don't want to just copy and paste stuff, but how could I let this pass?

Keynes vs. Hayek - The Rap Battle

They should use this stuff to teach in colleges.

Keynes vs. Hayek - The Rap Battle

They should use this stuff to teach in colleges.

Wednesday, July 18, 2012

Got Cherry?

Heh. Got this via Dealbreaker - Warren Buffett, known for his extraordinary love of Cherry Coke, can't pick Cherry Coke out of a line-up!

Here, look!

Here, look!

Monday, July 16, 2012

On the continuing LIBOR saga...

Wow, has it really been 9 days since I posted something here last?

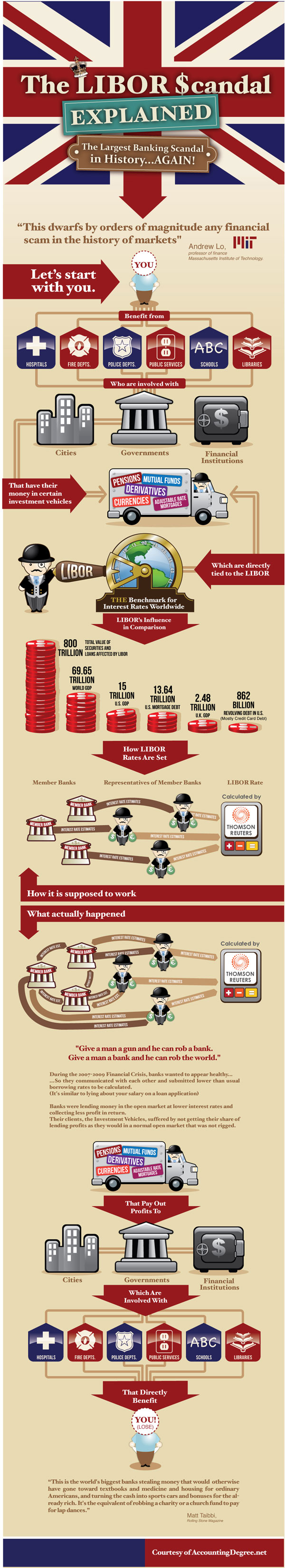

Have been busy but that shouldn't excuse the tardiness. I hope not to repeat this again. I haven't been totally off the grid, but have been collecting (assimilating?) info about the LIBOR saga, which is moving into really sticky terrain.

In no particular order,

In case you didn't quite get what LIBOR is from my long-winded explanation, here's a much better primer from Donald MacKenzie. What's in a number? One very important part that I left out earlier is that each input given by a bank is made public soon after the day's rate is published, which means that the manipulation, if any, was done entirely in public.

Here's a link to a MS report on 'LIBOR Risk Sizing' for banks. A lot of jargon. Skip past all the predictions; if someone's put it down on paper somewhere, its a pretty good bet its not going to happen. The interesting part begins from Page 7 onwards, where they start with implications for UK banks, then go on to give details of litigation that the banks find themselves in, and on Page 9, where they give the disclosures that various banks have made in their filings. UBS looks next in the firing line, which is also what the chatter around the market has been.

Some good editorials/blog posts: Lie More, as a Business Model, where the author correctly identifies the role of incentives in this, and in my opinion, most other scams. If your income depends on you lying, chances are that you will lie. Also read this excoriating piece from the Economist: The Rotten Heart of Finance. From The London Banker, which I haven't been following, but must now, comes Lies, Damn Lies and LIBOR.

And from FT's Martin Wolf:

My interpretation of the Libor scandal is the obvious one: banks, as presently constituted and managed, cannot be trusted to perform any publicly important function, against the perceived interests of their staff. Today’s banks represent the incarnation of profit-seeking behaviour taken to its logical limits, in which the only question asked by senior staff is not what is their duty or their responsibility, but what can they get away with.

Ouch.

The Economist, also to be noted, has made 'Banksters' an official term. This will hurt.

The Telegraph says Lock 'em up!

Here's a linkfest not of my making. The Big Picture blog rounds up articles from 2007-08 which were talking about the LIBOR scandal. None of this is new, its just blowing up now...

September 26, 2007: The Financial Times – Gillian Tett: Libor’s value is called into questionOne of these is a growing divergence in the rates that different banks have been quoting to borrow and lend money between themselves. For although the banks used to move in a pack, quoting rates that were almost identical, this pattern broke down a couple of months ago – and by the middle of this month the gap between these quotes had sometimes risen to almost 10 basis points for three month sterling funds. Moreover, this pattern is not confined to the dollar market alone: in the yen, euro and sterling markets a similar dispersion has emerged. However, the second, more pernicious trend is that as banks have hoarded liquidity this summer, some have been refusing to conduct trades at all at the official, “posted” rates, even when these rates have been displayed on Reuters.April 16, 2008: The Wall Street Journal – Bankers Cast Doubt On Key Rate Amid Crisis

The concern: Some banks don’t want to report the high rates they’re paying for short-term loans because they don’t want to tip off the market that they’re desperate for cash. The Libor system depends on banks to tell the truth about their borrowing rates. Fibbing by banks could mean that millions of borrowers around the world are paying artificially low rates on their loans. That’s good for borrowers, but could be very bad for the banks and other financial institutions that lend to them.May 2, 2008: The Wall Street Journal – Libor’s Guardian Bristles At Bid for Alternative Rate

The group that oversees a widely used interest rate fired back Thursday at an effort to introduce an alternative to the rate, known as the London interbank offered rate, or Libor. In recent weeks, the British Bankers’ Association, which calculates Libor, has faced questions about the accuracy of the rates that a 16-bank panel submits to reflect their dollar-denominated borrowing costs. The group said a review of how Libor is calculated “is due to report shortly,” though it declined to offer an exact date. It also noted that any substitute for Libor — which is supposed to reflect the rates at which banks make short-term loans to one another — would have to meet high standards to “win the market’s confidence.” On Wednesday, ICAP PLC, a London broker-dealer with offices in New York, said it plans to launch a new measure of the rates at which banks borrow dollars. ICAP expects to begin publishing the rate, known as the New York Funding Rate, or NYFR, as soon as next week, said Lou Crandall, chief economist at Wrightson ICAP, a New Jersey research firm that is part of the ICAP group. Mr. Crandall said NYFR isn’t intended to replace Libor.September 24, 2008: The Wall Street Journal: Libor’s Accuracy Becomes Issue Again

Questions on Reliability of Interest Rate Rise Amid Central Banks’ Liquidity Push

Earlier this year, Libor appeared to be sending false signals. Banks complained to the BBA that rival banks might not be reporting their true borrowing costs because they didn’t want to admit that others were treating them as if they had troubles. That led to a BBA review and the pledge that the rates banks contribute would be better policed. Every morning, 16 banks submit borrowing rates in a process that produces Libor rates at lunchtime in London.October 20, 2008: The Wall Street Journal – Bank-Lending Boost Could Spur Thaw

On Friday, three big banks led by J.P. Morgan Chase & Co. made multibillion-dollar offers of three-month funds to European counterparts, causing an immediate stir in the shriveled markets for unsecured lending. That raised expectations that lenders would finally open their doors and businesses would be able to borrow again, removing one of the biggest stresses on the global economy.In the story above (October 20, 2008), JP Morgan, a two trillion dollar bank, made $10 to $15 billion of LIBOR loans to other multi-trillion dollar banks and then proudly announced that LIBOR rates had fallen, the market was thawing and the credit crisis was easing. As we wrote in 2008, this was nothing short of rigging the market.Sum it up and all the revelations we are reading about this week were already evident about four years ago. None of should be surprising. As Jean-Claude Juncker told us last year, “when it becomes serious, you have to lie.”

David Merkel of The Aleph Blog delves into the LIBOR rates from 2005-2008 and this is what he comes up with:

My initial diagnosis is this: whether formally or informally, you have two groups of banks submitting rates for LIBOR. One group is trying to pull LIBOR up, the other is trying to pull LIBOR down. Statistically, if I add up their intercept terms from the first table, they both sum to 0.23%, one positive, the other negative. Even if LIBOR were a simple average, which it is not, this is a colossal game of tug of war, with two equal teams.As it is, LIBOR excludes the outliers, and calculates an average off of those that remain. It’s a difficult measure to manipulate. There may have been attempts to manipulate LIBOR, and even two groups of banks trying to pull LIBOR their own way, but successful systemic manipulation of LIBOR is unlikely in my opinion.But if you disagree, here are the two clusters of banks, pursue their collusions:Coalition to pull LIBOR up

- Barclays

- BTMU

- Credit Suisse

- HBOS

- Norinchuckin

- RBS

Coalition to pull LIBOR down

- Citi

- HSBC

- JP Morgan

- Lloyds

- Rabobank

Start with Barclays and JP Morgan, they are the outliers, and if there is collusion, they are the likely leaders.

When all this is settled, it'll only be the lawyers who are left standing. Lawsuits...and more of the same. Apparently, we're moving on to criminal charges as well, which would be novel. Also here and here. My question is, why isn't any Indian firm suing these banks? C'mon, surely, surely someone in India has entered into a LIBOR-backed transaction. Who'll step up?

The regulators knew something shady was up and really didn't bother about it... Here's Reuters on the same. This is the turn that the scandal has taken in the past week, with the focus shifted to the regulators. The NY Fed basically admitted that it knew Barclays used to manipulate LIBOR and did almost nothing about it. This should mean more bad news for the banks. If the regulators find themselves falling into a shit-hole, you can damned well be sure that they won't go in there first, or at least, not before pushing everyone else in before them. And now they'll be under more pressure to come down even more harshly on the banks.

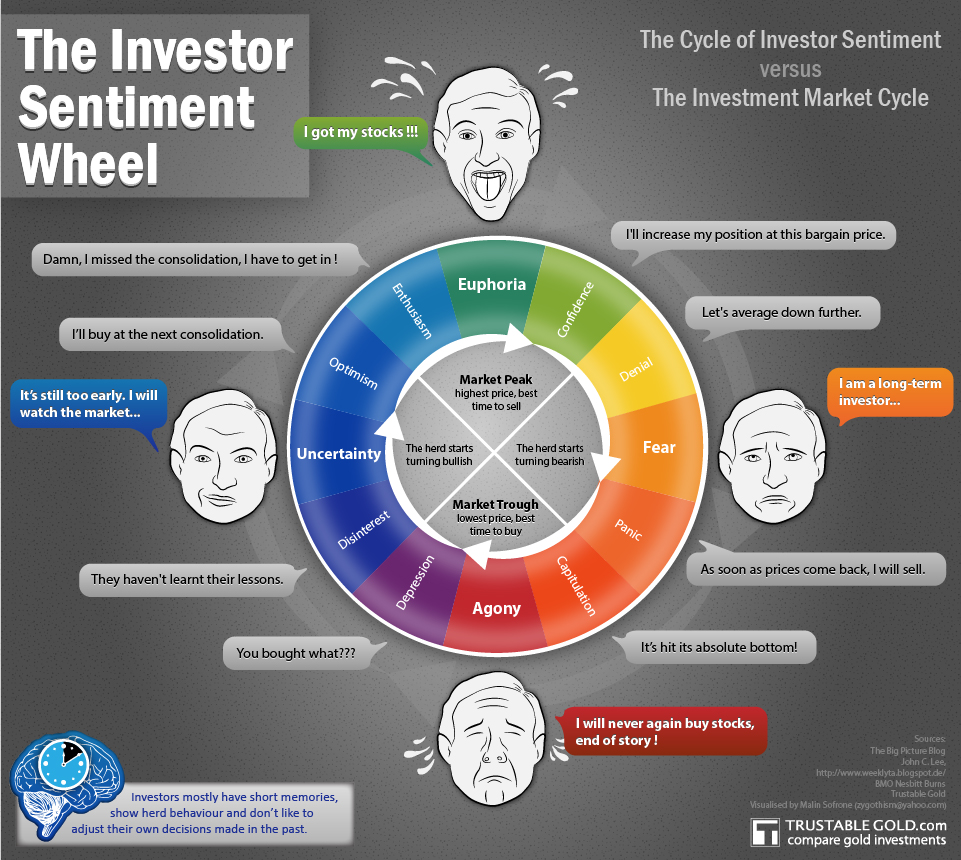

And after reading all this LIBORamayana, if you're still asking who/what LIBORam is, go here and here and also, see this:

Saturday, July 7, 2012

I want me this job...

In connection with the Merger described in Item 2.01 of this Current Report on Form 8-K and pursuant to the terms of the Merger Agreement, effective as of the effective time of the Merger, William D. Johnson, the former Chairman, President and Chief Executive Officer of Progress Energy, was appointed as the President and Chief Executive Officer of Duke Energy.Mr. Johnson, age 58, was Chairman, President and Chief Executive Officer of Progress Energy, from October 2007 through July 2, 2012. … Mr. Johnson previously served as President and Chief Operating Officer of Progress Energy, from January 2005 to October 2007.Mr. Johnson subsequently resigned as the President and Chief Executive Officer of Duke Energy. See disclosure below under the heading “Resignation of Mr. Johnson and Reappointment of Mr. Rogers.”

He was hired, and fired, within three paragraphs. Oh, and within 5 days too.

Don't feel too bad for him though, for lookee what he gets!

For his part, Mr. Johnson has received a lucrative exit package, according to a securities filing. He will receive payments of about $44 million, which includes a $7.4 million severance. He receives a lump-sum payment of $1.5 million so long as he does not disparage Duke and cooperates with the company.

See, even finance can be fun! Read those two links if you want to get into all the nitty-gritties...

Yes, I know I promised I'd write about 'Indian' happenings... And I will, just as soon as I find something juicy enough!

Oh, and be warned, more LIBOR juice to come in during the week!

Tuesday, July 3, 2012

LIBOR Cyborg - IV

I'm sorry, I really didn't want to do one more, but what else is there?

The Chairman resigns, taking moral responsibility for an executive decision. CEO digs his heels in and not-so-subtly threatens the Central Bank. Next morning, like a palace coup, the CEO is gone. His replacement will be chosen by the going-going-gone-but-not-really Chairman. There's news that the COO might be following the CEO. Isn't it simply delightful when a scandal is upon us?

It is becoming obvious that the Board decided to sacrifice the Chairman in order to save the CEO, but things got so far out of hand that he simply couldn't be saved. Its also come to light that the CEO was, in effect, asked to be thrown out by BOE Governor's eyebrows Juicy.

Oh and wait for it, there's a Parliamentary meeting on the issue tomorrow, at which the now-ex CEO is going to testify and where he reportedly plans to put a part of the blame on BOE by saying that he was told by BOE officials that you know, you don't really have to tell them what you think your actual LIBOR rates are. And whatever little incentive he might have had to keep his trap shut must have been totally thrown out of the window by this removal, right? Cannot wait for that to get over now...

The BBC says The City of London is in panic. One man's panic is another man's entertainment you know...

Reads:

Labels:

Bank of England,

Barclays,

BBC,

Bob Diamond,

BOE,

LIBOR,

LIBOR Series,

London

LIBOR Cyborg - III

Whoa, whoa, whoa... This is huge.

Barclays CEO Bob Diamond has resigned today with immediate effect. From the press release:

Source: FT Alphaville and here

The search for his replacement would be helmed by Marcus Agius, the Chairman who resigned yesterday. I suppose he'd be staying on now till a new CEO is found.

And here's the letter he sent to Barclays staff yesterday: CEO Letter

Somebody's actually losing his job? That's a new one, no?

Barclays CEO Bob Diamond has resigned today with immediate effect. From the press release:

3 July 2012Barclays PLC and Barclays Bank PLC (Barclays)Board changesBarclays today announces the resignation of Bob Diamond as Chief Executive and a Director of Barclays with immediate effect. Marcus Agius will become full-time Chairman and will lead the search for a new Chief Executive. Marcus will chair the Barclays Executive Committee pending the appointment of a new Chief Executive and he will be supported in discharging these responsibilities by Sir Michael Rake, Deputy Chairman.The search for a new Chief Executive will commence immediately and will consider both internal and external candidates. The businesses will continue to be managed by the existing leadership teams.Bob Diamond said “I joined Barclays 16 years ago because I saw an opportunity to build a world class investment banking business. Since then, I have had the privilege of working with some of the most talented, client-focused and diligent people that I have ever come across. We built world class businesses together and added our own distinctive chapter to the long and proud history of Barclays. My motivation has always been to do what I believed to be in the best interests of Barclays. No decision over that period was as hard as the one that I make now to stand down as Chief Executive. The external pressure placed on Barclays has reached a level that risks damaging the franchise – I cannot let that happen.I am deeply disappointed that the impression created by the events announced last week about what Barclays and its people stand for could not be further from the truth. I know that each and every one of the people at Barclays works hard every day to serve our customers and clients. That is how we support economic growth and the communities in which we live and work. I look forward to fulfilling my obligation to contribute to the Treasury Committee’s enquiries related to the settlements that Barclays announced last week without my leadership in question.I leave behind an extraordinarily talented management team that I know is well placed to help the business emerge from this difficult period as one of the leaders in the global banking industry.”Commenting, Marcus Agius said, “Bob Diamond has made an enormous contribution to Barclays over the last 16 years of distinguished service to the Group, building Barclays Investment Bank into one of the leading global investment banks in the world. As Chief Executive he has led the bank superbly. I look forward to working closely with the Chief Executives of our businesses and the other members of the executive Committee in leading Barclays world class businesses in serving our customers and clients and delivering value for our shareholders.”

Source: FT Alphaville and here

The search for his replacement would be helmed by Marcus Agius, the Chairman who resigned yesterday. I suppose he'd be staying on now till a new CEO is found.

And here's the letter he sent to Barclays staff yesterday: CEO Letter

Somebody's actually losing his job? That's a new one, no?

Labels:

Barclays,

Bob Diamond,

LIBOR,

LIBOR Series

Subscribe to:

Posts (Atom)